Counter-intuitive as it seems, the Bank of Canada is losing money due to rising interest rates, and may need a government bailout to cover its 2022 losses.

The feds are about to bail out the Bank of Canada | The Hub - Jules Boudreau:

October 19, 2022 - "Between April 2020 and December 2021, the Bank of Canada added $360 billion of bonds to its balance sheet as part of its quantitative easing (QE) program. It mostly bought Canadian government bonds, but also provincial bonds and mortgage-backed securities. Outside of the first few months of the crisis, when it helped prevent Canadian financial markets from seizing up, QE probably had a negligible effect on the Canadian economy. Swapping one type of government debt (government bonds) for another (bank reserves) did not cause the current surge in inflation. But it did have a major impact on the state of government finances going forward.

"We will have a preview of this 'QE bomb' on public finances when the Bank reveals it generated a negative net income in 2022 and Ottawa is forced to bail it out. The Bank should be transparent about the upcoming shortfall and add safeguards around the use of quantitative easing policies going forward.

"Prior to 2020, every year the Bank of Canada sent around $1 billion to the government of Canada in remittances. Those steady remittances were 'seigniorage' profits: because the Bank has a monopoly on currency issuance, it can produce bank notes at close-to-zero cost, sell the notes to banks, and use the proceeds to buy bonds. The business of trading bank notes, on which the Bank pays no interest, for interest-bearing bonds allowed the Bank to self-finance its operations..... It would then send the surplus to the government. Seigniorage is the federal government’s golden goose: the feds receive a steady billion annually in exchange for granting the Bank the privilege of issuing currency.

"But in 2020, the Bank ditched its ingenious zero-reserves 'corridor' monetary system, in which commercial banks send funds to each other to manage their liquidity needs, for a 'floor' system, in which commercial banks hold reserves at the central bank. Think of reserves as central bank money, on which the Bank pays interest. The implementation of this new system, combined with pandemic QE, means that bank notes — the golden goose — today only make up 28 percent of the Bank’s liabilities, down from 78 percent in 2019 (chart 1). Bank notes are now eclipsed on the Bank of Canada’s balance sheet by interest-bearing reserves and reverse repos. When the Bank hikes its policy rate, it increases the interest payments it makes to banks and other financial institutions.

Chart 1. Graphic credit: Janice Nelson

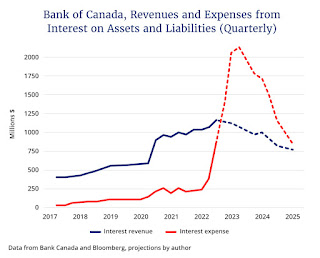

"With one hand, the Bank receives interest from its bond holdings. With the other, it sends interest payments to banks. The problem is that government bonds offer a fixed interest rate, while the interest paid by the Bank on reserves scales with the Bank’s policy rate. And with Canadian rates surging, the Bank’s interest expense is about to exceed its interest revenue (chart 2)....

Chart 2. Graphic credit: Janice Nelson

"When the government sells a bond to finance its spending, it chooses the optimal maturity of the bond to issue. If it wants to 'lock in' an interest rate to protect itself from future changes in borrowing costs, it will issue a long-term bond, for example, a 30-year bond. But what happens to the government’s balance sheet if the Bank of Canada purchases the 30-year bond? That long-term bond is replaced by an ultra short-term bond: bank reserves, on which the Bank — and by extension the government — pays the overnight rate....The data shows that the impact on consolidated government debt profile is immense. When we factor in the Bank of Canada’s holdings of Government of Canada bonds, the average weighted maturity of the government’s debt drops from 6.7 years to 4.7 years, rendering government borrowing costs about 30 percent more vulnerable to a rise in interest rates....

"Should the unelected Bank of Canada have such an impact on the government’s debt profile? Especially since, outside of periods of acute liquidity shocks like April 2020, QE’s effects on the economy are debatable. Hindsight is 20/20, and we can’t blame the Bank for emptying the cupboard in unprecedented times. But going forward, the Bank should install safeguards around the use of its balance sheet to gobble up government debt. The Bank of Canada should also commit to eventually returning to its previous corridor system to reduce its footprint in the government bond market."

Jules Boudreau is an economist in the Multi-Asset Strategies Team at Mackenzie Investments, a Canadian asset manager.

Sadly, so goes #CLOWNWORLD #KANADA https://www.minds.com/groups/profile/463051176707891211/feed

ReplyDelete